Month: October 2014

How student Loan forgiveness program makes life easy for students

Barack Obama is leaving no stone unturned for providing monetary relief and relaxing the norms of Student Loan repayment program. Millions of students can now opt for forgiveness scheme and stand to get more attention in terms of employability and financial stability from the Federal agencies managing the Loan accounts. The scheme on Forgiveness is directed at student who were either unable to complete their education for the need of funds or have completed their curriculum but their repayment stands unpaid owing to low income.

We cover top 5 points related to the Questions being frequently asked related to the principles of Student Loan Forgiveness Scheme. These points emphasize on how student Loan forgiveness program makes life easy for students.

What is the major assistance offered by the student loan forgiveness plans?

The major advantage of student Loan forgiveness program is that it offers the borrower some space to rethink his financial stature. The borrower no longer needs to bear the burden of the debt amount for at least some amount. This ensures that the student can focus on his monthly expenses and repay the debt sum with lesser factor. It also has the provision of reducing the owed money and put a ceiling cap on the payment sum as well as the interest rates pushing them to a payable amount.

Does Forgiveness program ensure affordability?

Yes. The Student Loan Forgiveness Program ensures that you pay less monthly rate which in turn strengthens your affordability. You no longer have to dread about paying a greater sum to the debt clearance and instead choose to go with a little better expense sheet linked to your income.

What are the basic highlights of the military student loan forgiveness?

Student Forgiveness program is specifically aimed at students who are serving the military and have been paying the loan sum consistently for years. This marks a vital key in providing an inspiration to the youth who wish to pursue further education and also join military ranks as their career prospects. It also covers the individual borrowers who have been serving at public service agencies and community welfare programs.

How does one apply for Obama’s student loan forgiveness program?

President Obama proposed that his student loan forgiveness plan will end or write-off substantial amount of loan amount if the borrower has been making regular and timely payments. To be entitled for the program, the borrower of the federal loan has to bear a clear record in terms of credit history. Regular payment for at least 20 years in case he or she is serving a private company or for 10 years in case he or she is working with a government agency, will earn the borrower an entry into the Student Loan Forgiveness Program.

Can the Student loan Forgiveness program be used to pardon the Private Loans as well?

No. Since the Obama Student Loan Forgiveness program is designed specifically to cover the amount derived from the Federal student Loan debt, private loans gave been excluded. Students who have outstanding loan sum to be given to the private loan providers will continue to pay the specified amount at the given rate.

Study: It’s Student Debt, Not the Economy, That Forces Millennials to Move In With Their Parents

Ask a millennial why so many twentysomethings live with their parents, and he’ll probably let out an exasperated sigh and then patiently explain that we’re a whole generation loaded down with student debt and navigating an economy that’s been cruddy for years. It’s hard to make your rent when you’re jobless and paying off a bachelor’s degree.

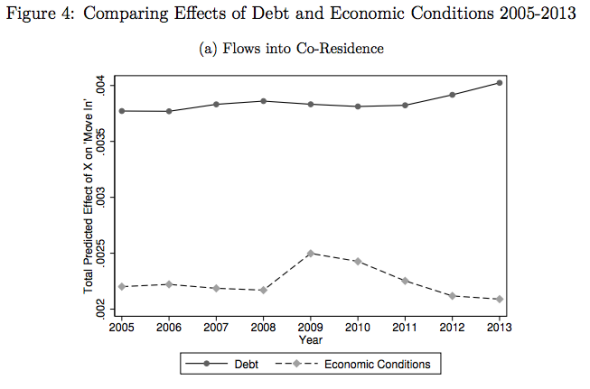

But that narrative may only be half-right, according to a new study by a pair of Federal Reserve Board economists. Student loans, the study argues, may be a big reason so many young adults are moving in with Mom and Dad. But the bad economy? Not so much.

Between 2005–2014, Lisa Dettling and Joanne Hsu write, the percentage of 18-to-31-year-olds living with their parents grew at an “unprecedented” speed, hitting a high of about 36 percent. Using credit agency data on more than 1.8 million young adults, they look at how changes in indebtedness and the economy writ large affected the rate at which the kids moved in with their parents. During this period, student loan burdens skyrocketed, while other types of debt shrunk back a bit. Meanwhile, we all know what happened to the unemployment rate.

Intuitively, it seems absurd to posit that the recession itself didn’t send millennials back into their parents’ basements. As Pew has pointed out, much of the increase in children living back at home seems to have been “concentrated” among young adults who never went to college. Are we really to believe that the astronomical unemployment rate didn’t play a role?

Dettling and Hsu’s paper also doesn’t draw a super-clean line between debt and the rest of the economy. It notes, for instance, that rising delinquencies seem to have increased the rate at which young adults moved back home. But delinquencies tend to rise when the overall economy goes sour. It seems hard to completely separate out causation.

That said, Dettling and Hsu’s findings may dovetail with other recent studies. As Neil Shah reported earlier today at the Wall Street Journal, for instance, Census Bureau researchers have shown that “the Great Recession’s impact on kids living with parents isn’t actually that special as far as recessions go.”

New studies with counterintuitive findings should always be treated with a dash of skepticism. But consider this one a bit of ammo for those who are particularly alarmed at the rise of student debt: College loans may bear greater responsibility than the Great Recession for the growing ranks of boomerang kids.

Resource of Article : http://www.slate.com/blogs/moneybox/2014/10/29/student_debt_and_millennials_college_loans_are_forcing_students_to_move.html

5 Strategies to Dig Out of Student Loan Debt

If you’re struggling to pay off a mountain of debt, here are some solutions.

These strategies can help you get out from under that mountain of student loan debt.

Mike Dominguez is the first to admit he should have gotten on top of his student loan debt earlier.

“Looking back, I could have done a lot of things different,” says Dominguez, 33, who lives in Austin, Texas, and recently started a business with his father, selling goods and professional services to government entities.

Dominguez has $71,000 in student loan debt from earning an undergraduate degree at the University of Texas at Austin. He hasn’t paid off a dime of his balance yet and cites living too extravagantly in his 20s and taking on low-paying internships as obstacles. But his credit score is still healthy, and he’s still in good standing with his lenders, who have helped him refinance and consolidate and defer the loans. He feels optimistic that he’ll eventually pay the loans off. Someday.

But the debt has been stressful, says Dominguez, adding that it has hurt his love life. “No one wants to be saddled with that type of debt or even marry someone with that amount of debt,” he says.

Dominguez feels his story is “rather common,” and unfortunately, he is right. U.S. student loan debt exceeds $1 trillion, according to the Consumer Financial Protection Bureau. And last month, a report from the Government Accountability Office got a lot of attention when it pointed out that between 2005 and 2013, student loan debt among seniors 65 and older climbed more than 600 percent from $2.8 billion to $18 billion.

“Student loans are tricky to get rid of, presumably because we want to make sure our citizens are well-educated,” says William Waldner, a bankruptcy attorney in New York City. “If they were easily dischargeable, lenders wouldn’t give them out nearly as liberally.”

So if you’re struggling to pay off or manage your mountain of student loan debt, here are some strategies consumers employ, along with the pros and cons of each.

Deferment

What it is. With this option, you defer paying your loans for a few months or possibly years. You may already be doing that if you’re missing payment dates, but now you’ll have permission from your lender.

Pros. You get a break from paying your loans with no hit to your credit score. You can use the extra money to pay off other debts, so you’ll be in better shape when you start paying off the student loans. Even better, the government may (emphasis on “may”) pay the interest on some of these loans, according to the Federal Student Aid website (studentaid.ed.gov). Specifically, it may pay the interest during this time on the Federal Perkins Loan, a Direct Subsidized Loan and/or the Subsidized Federal Stafford Loan.

Cons. If the government doesn’t pay the interest, you will. In that case, Chuck Mattiucci, a financial advisor at Fragasso Financial Advisors in Pittsburgh, has a plan. “Most banks and lending institutions will allow interest-only payments while loan principal payments are in deferral,” he says. “This would be the best option for most because the interest payments are a fraction of what the monthly principal and interest payments would be.”

Forbearance

What it is. It’s essentially the same as deferment, with one difference: If you are rejected for deferment but are given forbearance, you will definitely be paying the interest that accrues during your break in making payments.

Pros. As with the deferment, you get a break from paying your loans.

Cons. As noted, the infernal interest. Usually, the interest you’ve accrued will be added to the principal balance, so you’ve just stretched the length of your loan, and you’ll pay more in the long run.

Consolidation

What it is. Consolidation turns multiple loans into one loan, meaning one payment. If you have federal loans, you can apply to consolidate them at StudentLoans.gov. If you have multiple private loans you’d like to consolidate, you can apply to a private lender, like a bank.

Pros. Instead of having two or three or eight student loans to pay off, you’ll just have one, often with a lower monthly payment. That’s the main draw for a lot of consumers. Also, only having to make one monthly payment could help your cash flow.

Cons. The interest will be whatever the average is of your loans, and it’s possible that by consolidating your loans, you may pay more in interest in the long run.

Federal student loan forgiveness

What it is. In this case, the federal government will cancel part or all of your federal student loans. You have to apply for it and can download the application at the Federal Student Aid website.

Pros. Pretty obvious: You’ll have no or less debt.

Cons. Not only is it a long shot, but you’ll only be able to qualify in certain circumstances, such as working in the military or for certain nonprofit organizations or teaching or practicing medicine in low-income and rural communities. In other words, if you’re doing something noble with your career and you’re not likely to earn a lot of money, you may be able to get out of paying your student loans.

Student loan bankruptcy

What it is. This isn’t much of a strategy, and it’s generally something that people who feel buried under student loans wish could happen. You may end up going through bankruptcy, but odds are, you’ll emerge with your student debts in tow. “There is a hardship discharge, but this is a very difficult thing to show,” Waldner says. “If we can show that the debtor can’t work or earn income and hasn’t been working for a long period of time, the debt may be dischargeable.”

Pros. Who wouldn’t want to get rid of their student loans?

Cons. This is another long shot, and if you go into bankruptcy and try to unload your loans, “the student loan company will likely fight this, and the result will likely be a full-blown trial,” Waldner says.

And, of course, a trial is likely unrealistic. If you can’t afford to pay off your student loans, you probably can’t afford a trial.

Resource of Article : http://money.usnews.com/money/personal-finance/articles/2014/10/17/5-strategies-to-dig-out-of-student-loan-debt

Student Debt Could Reduce Home Sales 8% This Year, Report Says

Higher levels of student debt will reduce U.S. home sales by around 8% this year, according to a report released Friday by John Burns Real Estate Consulting, an advisory firm.

The paper examines the impact of student debt on purchase activity for households under age 40. Those households account for around two-thirds of student debt holders. It concludes that sales of new and existing home will total 5.26 million this year, with some 414,000 “lost” households as a result of rising student debt burdens.

Higher debt burdens will defer home purchases for many borrowers while requiring others to buy a less expensive home in order to qualify for a loan or save for a down payment.

The paper estimates that every $250 per month in student loan debt reduces borrowers’ purchasing power by $44,000, and since 2005, some 3.8 million additional households have at least $250 per month in student debt.

Put differently, around 35% of households under age 40 have monthly student debt payments exceeding $250, up from 22% of households in 2005.

The typical first-time buyer can qualify for a $234,080 mortgage without any student debt, but that figure falls as the monthly debt burden rises. (The analysis assumes that the traditional first-time buyer has income of $61,000.) Mortgage lenders generally won’t extend credit to borrowers whose total debt payments exceed 43% of their gross incomes.

The analysis assumes that most borrowers with $750 or more in monthly student debt payments will be priced out of the market unless they’re making much more money than the traditional first-time buyer. For the typical entry-level buyer with $750 in monthly student debt payments, they can qualify for a $103,280 mortgage.

But the analysis finds that many borrowers with modest monthly student debt payments are also lost transactions this year. It concludes that around 57,000 households with student debt payments of less than $100 won’t be buying homes this year, and that around 127,000 borrowers with payments between $100 and $250 are lost.

RESOURCE OF ARTICLE : http://blogs.wsj.com/economics/2014/09/19/student-debt-could-reduce-home-sales-8-this-year-report-says/?KEYWORDS=student+debt

Top 5 Benefits of Obama Debt Forgiveness Program

We take a look at the top benefits that will be evident in the Obama Debt Forgiveness Program. The loan forgiveness program stands to offer exciting features and advantages that will no longer be considered as a burden in long-term plan. Instead, the Student Loan program offered by the Federal Government is now tagged as the single most inspiring factor when it comes to enrolling into progressive academic curriculum.

We take a snap shot at some of the benefits achieved by the borrowers covered as part of the Federal Student Loan Forgiveness Scheme. These are related to the tax exemptions, public service benefits, long-term affordability and building relation with NGO’s and federal service agencies.

1 Tax Relaxations as per Section 108(f)

The borrowers who are covered under the Forgiveness scheme are exempted from the Tax payments as per the Section 108(f). The Internal Revenue Code shields the borrowers from being taxed if they are associated with particular occupations. The borrowers who have not worked with any public service agency will continue to be taxed by the federal government.

2 Work in a public service job to avail income-based repayment

Borrowers who are not working for public service agencies can still avail the income-based repayment scheme and apply for forgiveness after 25 years of consistent monthly repayment. Only if you are working in a public service job, the debt can be written-off in 10 years and not dragged for 25 years.

3 Relaxed eligibility to avail Loan Forgiveness:

The conditions to be covered under Forgiveness scheme consist of documenting and applying for the loan debt forgiveness every year if you are working with a public service agency. To take advantage of this public service loan forgiveness program, the borrower has to shift his federal loan payment into the more comprehensive Direct Loan Program. This ensures that the borrower is associated with the Public service for ten years before gaining forgiveness and does not leave the organization once the debt is written off. It will also allow the borrowers with income greater than the beneficiary sum to gain protection against taxes. It would greatly benefit the borrowers whose debt sum is a little less than their income slab.

4 Public service jobs get a boost:

As per the Federal Student Loan Forgiveness program, the definition of Public service jobs covers the following occupation:

- Teachers teaching in elementary, middle and high-schools

- First responders involved with policy, fire, EMT

- Public librarians,

- Social workers,

- Public defenders and prosecutors

- Medical officers

- People associated with tax-exempted NGO’s

- Military Personnel

In case your job fails to qualify for the public service loan forgiveness, the debt sum can be consolidated and linked effectively with the income-based repayment eligible for forgiveness after 25 years in service.

If you want to details on your qualification and eligibility, call 1-800-4-FED-AID (1-800-433-3243).

5 Repayments need not be consecutive:

The biggest benefit of being covered under Student loan Forgiveness program is that the borrowers need not make a regular payment in consecutive term. In case, if the borrower was laid-off and then got back his job, the scheme would not disqualify the person for non-payment of sum. The scheme continues to match the 120-month repayment deadline.

The Money Conversation Americans Need to Have

For All Their Worry About It, Few Broach the Topic

Americans are so reluctant to talk about money that even “the quiet company” is urging us to start yakking.

A recent study by Northwestern Mutual Life Insurance, which long marketed itself as “the quiet company,” concluded that Americans would rather talk about sex than about money.

This follows a survey by Wells Fargo in which investors ranked personal finance a thornier topic than either religion or politics, and a T. Rowe Price Group survey in which nearly three-quarters of parents admitted to having some reluctance to discussing financial topics with their children.

Not that money isn’t on lots of minds. Those surveyed by Northwestern Mutual rated personal finance a top priority (second only to personal health), and the majority felt their financial planning could use improvement.

Yet fully 42% have never spoken to anyone about their retirement, and only 39% have spoken with their spouse or partner about the subject.

“That really blew us away,” says Greg Oberland, president of Northwestern Mutual, who was struck by the “significant gap” between investors’ professed desire to take responsibility for their finances and their tendency to shun money-related conversations.

Step 1: Worry

Mostly we worry about money. A lot. Money has ranked as Americans’ No. 1 source of stress for six years running in an annual survey by the American Psychological Association. (It tied or virtually tied with work in 2006 and 2007, the first two years the survey was conducted.)

One-third of those polled by Wells Fargo said they’ve actually lost sleep over money, and a third of respondents in a survey by GOBankingRates said they worry about money “all the time.”

The biggest reported obstacles to improving our financial health: lack of time (according to the Northwestern Mutual study) and lack of knowledge (according to the Wells Fargo survey.) So it seems we don’t have time to talk about finances even if we wanted to, and we wouldn’t know where to begin anyway.

Complicating matters: In polite conversation, money remains taboo. “It’s still considered a private and personal topic,” says Lizzie Post, a co-author of “The Etiquette Advantage in Business, Third Edition,” and great-great-granddaughter of Emily Post. People avoid the subject “either because they’re uncomfortable talking about it or they’re not sure their friends or family are comfortable talking about it,” she says.

That doesn’t mean it’s off limits, she adds. “It’s OK to broach the subject with someone you think manages their money really well and say, ‘I’d really like to get your opinion on this.’ That’s the way to invite a conversation and give the person an out.”

Mr. Oberland suggests a similar approach for those who’d prefer professional help but don’t know where to turn: Ferret out a referral. “Ask somebody you trust, ‘Hey, you seem to be doing OK. Do you work with anybody?’ ” he says.

Spouses are challenged to find time to talk money with each other, Mr. Oberland admits. “It’s not something you’re going to sit down at 9 o’clock at night after a long day and discuss,” he says.

Try scheduling a mutually convenient time when you’re both likely to be in the right frame of mind, says Syble Solomon, author of “Bringing Money into the Conversation,” a guide for therapists working with clients with money issues, and creator of “Money Habitudes,” a card game designed to get people comfortable talking about money.

“Start simple,” adds Mr. Oberland. Tackle basics like saving and budgeting before addressing more complex topics like asset allocation.

Lessons by Stealth

With your children, you needn’t have formal, sit-down talks about money, says Judith Ward, a senior financial planner at T. Rowe Price. Better to embed mini lessons throughout the week, for example, when shopping at the supermarket or planning for the weekend. T. Rowe Price lists a dozen such “teachable moments” at MoneyConfidentKids.com.

Kids whose parents frequently talk to them about finances are more likely to feel smart about money and to identify themselves as savers rather than spenders, the T. Rowe Price study found. And presumably, more likely to feel comfortable talking money as adults.

RESOURCE OF ARTICLE : http://online.wsj.com/articles/the-money-conversation-americans-need-to-have-1411862870

How can I consolidate Federal Student Loans

Consolidation of two or more student loan schemes is easiest way to bail out of the burden of strict repayment policies and helps in better tracking of the payment schedule. It also offers an excellent way to consolidate the interest rates into one single factor. The borrowers from the Student Loan program often ask questions that link their income with the consolidation scheme.

We point out top 5 frequently asked questions that people ask related to the consolidation of Federal Student Loans. The following queries will help the borrowers plan out a better program based on the Income-Based Repayment clubbed with the public service loan forgiveness scheme. The answers cover eligibility conditions and benefits that can be availed by linking the consolidation part with the income factor.

Questions about Consolidation of the Repayment

- How do I consolidate the debt amount with income-based repayment?

Most loan providers offer a service number or a customer care number that connects you to the current holder of the loan sum. It will ask you whether to stay with the present scheme or switch over to an income-based repayment mode. The procedure is forwarded by completing a standard form filling process. It is done by filing for the “Alternative Documentation of Income” when you are into your very first year of income-based repayment. Keep a statement of your yearly Income tax returns.

- Is the consolidation scheme available for private student loans?

The consolidation of the loan repayment linked to the income is set under the Federal plan meant exclusively for the students covered under the Federal Student Loan program. The terms & conditions of private student loan scheme are set up by the banks and financial institutions offering the sum and not the Federal government, the private loans can’t be covered with consolidation.

- If I am repaying the student loan for the last 25 years, can I switch to consolidation scheme now and get a write-off for my reminder amount?

Forgiveness can only begin after 25 years of repayment if you are linked to income-based repayment. A borrower can be considered for consolidation as part of forgiveness after a standard 10-year repayment plan only if he or she has paid the debt amount in full in ten years flat. The consolidation is applicable to the student loan borrower proving beneficial to them owing to a reduced financial hardship.

- Will the Federal agency club my spouse’s income to the consolidation for monthly repayment?

Monthly repayments are calculated based on your income alone. In case you have filed for a joint Income-tax return, both your incomes will be considered for the repayment scheme and you can consolidate accordingly. Conversely, if you are married and filing the repayment separately only your income will be considered as the base.

- Can I expect the lowest monthly payment using consolidation repayment?

Most borrowers can expect to fetch lowest monthly payments based on an extended repayment or a scheme linked to consolidation over income-based repayment. Borrowers who have a low sum as debt in comparison to their income will qualify for a lower monthly payment under a consolidated extended repayment scheme.